Eviction armageddon imminent despite billions set aside for struggling renters

President Biden will be remembered for callous refusal to extend eviction moratorium

Short on time? Read to the red line for the highlights. Want to learn more? Items that are bolded in the top section are expanded upon beneath the red line.

During the pandemic, this once-per-month newsletter may be split into two issues: one monitoring developments related to the COVID-19 pandemic, and one for other news on housing justice.

Links to our projects: Housing for All podcast | Housing for Us podcast | YouTube channel | previous issues of this newsletter | homepage

The top line for this issue: The federal eviction moratorium will expire on July 31, and the Biden Administration has indicated that it will not be extended. Well over 6 million households — far more than 10 million people total — are behind on unpayable sums of rent.

Meanwhile, billions of dollars are set aside for emergency rental assistance: cash from the federal government that is supposed to pay off unpaid rent. But due to several insurmountable obstacles, the majority of this aid will not reach people in time and will simply be unspent.

So — even though there is likely enough money set aside to prevent every eviction caused by the pandemic — the money won’t actually get where it needs to go in time.

Maddeningly, there were three rounds of emergency rental assistance, and all of them ran aground on the same issues. Overall, the emergency rental assistance model simply does not work: after three tries we can say affirmatively that this model cannot get cash to the people who desperately need it. So if it failed once, twice, then three times, why did Congress keep trying over and over with a failed model?

We’ve pointed fingers at the Biden Administration for failing to take appropriate steps to protect American renters, and that’s the case here as well. Biden could have extended the eviction moratorium for several months, pointing to an astonishing finding from Eviction Lab (emphasis added): “We found a pattern of higher eviction filing rates in neighborhoods with lower vaccination rates in every jurisdiction for which we were able to locate data.” Biden’s cruelty in not extending the moratorium is unfathomable, especially since the pandemic is clearly not over.

But for the reliance on the broken emergency rental assistance model, blame lies squarely with Republicans.

We’ll look at this story in more detail below the red line. However, when Trump signed into law the first round of emergency rental assistance in March 2020, it was considered best practices by housing policy experts. And when the second round was passed in December 2020, again by Trump, the alarm bells hadn’t started sounding about the first round. That’s because the deadline to spend the money was January 1; since the second round was passed before that date, it hadn’t become clear at the time about the insurmountable obstacles the program was encountering.

Those alarm bells started going off in February, and in earnest by March. Since the third round was passed in March, Biden and lawmakers in Congress should have known about the problems and would have had time to fix them.

Unfortunately, the legislative process for that third round had begun in January, with Republicans acting in extremely bad faith. Despite passing remarkably similar legislation twice under President Trump, Republicans put up every roadblock they could, and ultimately not a single Republican voted for the final law. In sum, there would have been time to design a different approach but Republican obstructionism made changes to the legislation virtually impossible. Maybe the Democrats would not have come up with a better idea, but the Republicans denied them — and the American people — the chance to avert an eviction armageddon.

The human costs of this folly are mere days away and will be staggering: 6.4 million households, accounting for well over 10 million people, are behind on unpayable sums of rent. Millions of people will be getting thrown out on the street, their lives upended. They might lose most or all of their possessions, lose their job or their kids, suffer physical and mental health ramifications for years. They might spend time in homeless shelters and face increasing difficulty finding housing with an eviction on their record.

This was preventable and extraordinarily unfair. What could an ordinary person have done to prepare for a once per century pandemic with the worst job losses since the Great Depression?

Foreclosure armageddon averted

Let’s start with the good news!

The Consumer Financial Protection Bureau effectively made foreclosures illegal through 2021. Though not an outright ban, a lender can only foreclose on a home prior to January 1 if it has been abandoned. That means that even struggling homeowners who were ineligible for the extremely generous forbearance program will likely avoid the catastrophe of a foreclosure. As we’ve previously reported, several million homeowners have participated in that forbearance program.

Of course, these aren’t all happy endings. A lot of people weren’t able to recover and had to sell their homes. But a foreclosure is a disaster. You don’t just lose your home; you also lose your down payment, any equity you built in your home by paying off your mortgage, and your credit is destroyed. Far better to lose your home but keep your down payment, all the equity you built by paying off your mortgage (minus the amount you were behind on your mortgage when you sold), plus the increase in your home’s price in the hot real estate market.

Everything else this issue is terrible.

The final, desperate attempts at avoiding eviction armageddon

When we published last month’s COVID issue on June 23, the federal eviction moratorium was set to expire in just 7 days. The next day, on June 24, President Biden extended it until July 31; a White House fact sheet states that this will be the final extension.

According to the National Equity Atlas, 6.4 million renter households are behind in aggregate $21.3 billion in rent or about $3,300 per household.

As we reported last month, the problem is getting worse, not better: 5.7 million renters were behind on rent in April, 5.8 million in May, 6.0 million in June, and now 6.4 million for the last week of June/first week of July. Additionally, these are households, not people. Since a typical household has more than one person in it, the number of people facing catastrophe is well over 10 million.

Adding to last month’s story on the painfully slow roll-out of the billions of dollars set aside for emergency rental assistance, a June 15 report from CNBC found that many states had distributed under 5% of their emergency rental assistance; Colorado’s state program had distributed 1.5% and Wyoming’s 0.1%. As of June 10, just 2% of the applicants to California’s state program received assistance; additionally, the program received fewer applicants than expected because so many people who are eligible for the program don’t even know it exists. According to the latest Treasury Department data (ending in May), just $1.5 billion out of the $22.4 billion has been distributed, helping just 350,000 households. All data point to a stunning policy failure.

This adds up to catastrophe just days away. Millions of people are behind on rent by an insurmountable sum, and while money has been allocated to rescue them, it won’t reach them in time. Since Biden promised this would be the last extension, we can expect an eviction armageddon on August 1.

Some people will still be protected by state and local eviction moratoria. But according to Evicton Lab’s tracker, 7 states (including very populous ones like Georgia and Ohio) never had any state-level eviction moratorium (or any tenant protections whatsoever) and many more states have long-since phased out their moratoria (Alabama’s was phased out on June 1, 2020; Louisiana’s on June 15, 2020; Arizona’s on October 31, 2020; etc). In sum, an extraordinary number of people will not be protected by any moratorium.

Take the &@#$ money! Give them the &*#@ money!

With the increasingly desperate situation, the Treasury Department issued new guidance in a last-ditch effort to get more money to those who need it by July 31. A major problem has been landlords refusing to accept emergency rental assistance — turning down thousands of dollars in cash to instead throw their tenants to the street. Since so many landlords aren’t taking the @#$% money, the Treasury Department instructed ERA programs to give tenants the money (it is supposed to go to the landlord directly). Issuing the cash to tenants instead ought to solve the problem; landlords are under no obligation to accept money from a rental assistance program, but they must accept money provided by the tenant (imagine if your landlord refused to cash your rent check, then evicted you for not paying your rent).

The National Low Income Housing Coalition has said that, “According to federal guidance, [emergency rental assistance] programs should provide direct-to-tenant payments when landlords or utility companies refuse to participate or do not respond to program requests.” However, “In late April, only 15% of programs clearly allowed for direct-to-tenant assistance. In late May, 23% of programs did. As of June 16, 26% of programs do.”

Astonishingly, as of July 12, only 27% of programs offer direct-to-tenant assistance — just 1% higher than June 16. In nearly a month — as it became impossible to deny that direct-to-tenant assistance was the only way to get money to tenants — just 6 programs in the entire country decided to start offering direct-to-tenant assistance, despite federal guidance instructing them to do so. Clearly, the emergency rental assistance model fundamentally does not work; the programs holding the money either can’t or won’t keep up with federal guidance and best practices.

Just give the renters the @#$% money!

Most renters do not know emergency rental assistance exists in another astounding policy failure

A June survey (covering May) by the Urban Institute found that only 43% of tenants are even aware of the emergency rental assistance program. That means a solid majority of renters never found out about the program. Only 60% of landlords are aware of the program; presumably, many smallhold landlords really would benefit from their tenants utilizing the program and would help them apply. The failure to even get the word out about a desperately-needed program is astonishing.

Too little, too late

In another extraordinary failure, it took until late June for the Treasury Department to release guidance (p8) on making “easily navigable websites that inform renters” about emergency rental assistance. Given that nearly all tenants would find out about the program and apply via the web, this is an astonishing oversight.

Some money not that hard to spend

Agencies distributing Emergency Rental Assistance money can use up to 10% of the funds for administrative costs; according to a study, most programs have been able to successfully spend the entirety of this 10% on administrative costs. So at least some of the money is being spent.

Armageddons are expensive to the public

Aside from the catastrophic human suffering the eviction armageddon will unleash, the public will also bear enormous fiscal costs. One study estimated costs for the state of Oregon could reach $4.7 billion — in a state with a population of just 4.2 million. That estimate attempts to account for increased utilization of homeless shelters, greater need for child welfare and medical services, and the like. With 330 million people in the US, we will be paying a lot of money to deal with the effects of this catastrophe. We’ll look at that study in more detail, as well as some other estimates, below the red line.

Slap in the face

When the White House released a fact sheet on June 24 cheerfully stating they would not extend the eviction moratorium again, they also listed out what they plan to do to help struggling renters with that impending July 31 doomsday. First on the list was “Urge State and Local Courts to Participate in Eviction Diversion Efforts.” This is laughable; throughout the pandemic, so many state and local courts have been actively undermining the moratorium (you can find examples in these issues and others). What good could some 11th hour “urging” really do?

For a new example: “In one Indiana county, the court was discovered to be using a court reporter to issue pre-signed eviction orders, refusing to allow tenants to even speak to the judge before stamping a court order forcing them out.” So...there are states that resisted setting up rental assistance programs, programs that refuse to implement best practices (like direct-to-tenant assistance) in spite of federal guidance, and courts that are actively undermining the eviction moratorium. Clearly, no amount of “urging” is going to make a difference.

We look at a few other useless suggestions from Biden below the red line, then think about what concrete things he actually could have done.

Forbearance for landlords extended

Currently, landlords with mortgages owned by Fannie Mae or Freddie Mac can apply to enter a forbearance plan until September 30 (though forbearance plans are only for 3 months). Not all landlords’ mortgages are owned by Fannie or Freddie, but this still protects a huge share of landlords, as we discussed in episode 4 of Housing for All. Meanwhile, the eviction moratorium ends on July 31.

Supreme Court upholds eviction moratorium

The Supreme Court upheld the constitutionality of the eviction moratorium 5-4. The attorneys general of 22 states plus D.C. begged the Supreme Court not to strike it down, and that might have helped. On the other hand, it’s hard not to think that the two conservative justices who joined the court’s three liberals were protecting landlords from themselves. As in the New Deal, upholding tepid reforms today can prevent more radical changes tomorrow.

Rents still soaring

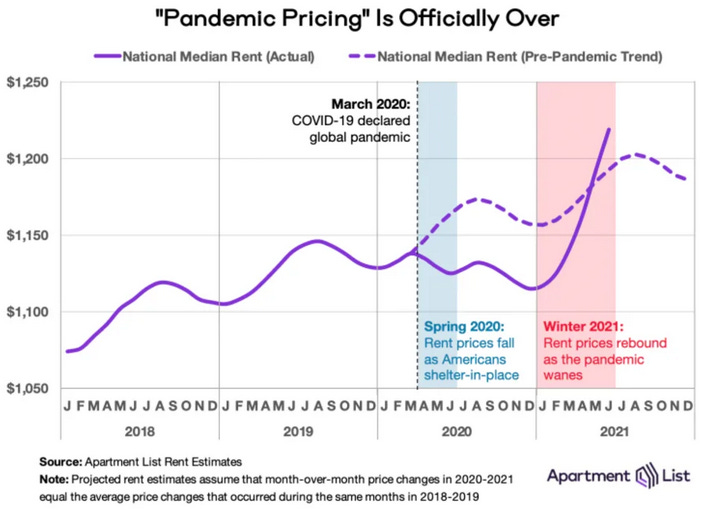

In the last issue, we covered the bad news of soaring rents — as though things weren’t already bad enough for American renters. Per Apartment List, it’s nonstop:

Our national index increased by 2.3 percent in June, continuing the trend of rapid price growth since the start of the year. So far in 2021, rental prices have grown a staggering 9.2 percent. To put that in context, in previous years growth from January to June is usually just 2 to 3 percent. After this month’s spike, rents have been pushed well above our expectations of where they would have been had the pandemic not disrupted the market.

It’s hard to appreciate just how extraordinary these rent increases are. Obviously, rents fell precipitously early in the pandemic. Apartment List used the last few years of rent data to estimate what rents would have done if there were no pandemic. Astonishingly, rents are now higher than what would be expected had we been following historical patterns:

Miscellaneous

In episode 1 part 1 of Housing for All we talked about the plight of small-hold landlords. For the dataset we looked at, a shocking 95% had negative cashflow or were on the brink of insolvency. The Terner Center looks at how well that set of landlords did during the pandemic (they did not do well).

California Governor Gavin Newsom made a splash promising to forgive all unpaid rent for low income households. We’ll see below how this promise isn’t nearly as amazing as it sounds.

The definition of insanity: doing the same thing and expecting a different result

Above, we outlined the sordid story of three failed rounds of emergency rental assistance. Here, we’ll elaborate on the timelines.

The first round of emergency rental assistance was included in the CARES Act, passed in March 2020. We know now that this model does not work, but at the time, housing policy experts considered it to be the best option. What’s more, it took many months for information to trickle out about the program’s stunning failures. The National Low Income Housing Coalition (NLIHC) has been closely reporting on pandemic news as it related to rental housing policy. The very first mention of CARES Act emergency rental assistance having the problems in NLIHC’s weekly Memo appears to be from the December 22 issue, where a single story in the New York Times was briefly mentioned. This story suggested that some programs would not be able to spend all their money before the January 1 deadline. Clearly, there wasn’t enough information early enough to influence the second round of emergency rental assistance, which was signed into law on December 27.

After Trump signed the second round into law, the Memo doesn’t mention this issue for all of January and only in passing in February.

In February — a full month before Biden’s emergency rental assistance program was signed into law as a part of the American Rescue Plan — the Urban Institute found that only 31% of renters even knew ERA existed. By then, emergency rental assistance had been around for nearly a year, yet tenants were still unable to find out about it. Based on this information, lawmakers and the Biden Administration should have demanded data from the Treasury Department, which would have shown the program going down in flames.

The very first issue of our newsletter was published on December 21, and our first reporting on the program having difficulties wasn’t until the April issue:

Because rental assistance is allocated at the local level, it is impossible to make a general statement about how well these funds are being distributed. But you don’t have to look hard for fiascos. For example, as of March 2, St. Louis has not been able to distribute a single penny of the $9 million it received for rental assistance in January. As of March 5, neither had Madison County, the third most populous county in Alabama. And as of March 6, Broward County, the second most populous county in Florida, also had not been able to distribute a single penny of the $59 million it was allocated in January. The City of Atlanta was only able to disburse about half of the $22 million it was allocated by the CARES Act in March 2020…

In addition to problems at the local level, some states are having difficulty assigning funds to local governments. Pennsylvania was allotted $150 million for rental assistance from the CARES Act; an appalling $96 million never made it to tenants and was mostly spent on Department of Corrections payroll. (Some of the $25 million Pennsylvania was allocated by the CARES Act to help people catch up on the mortgage payments also didn’t reach those who need it.) These issues reached new heights of barbarism in Idaho and Michigan as Republicans in those state legislatures are attempting to prevent their state’s share of emergency rental assistance from being used at all.

Overall, this system of money filtering down through multiple levels of government (from the federal Treasury Department to state governments to local governments) is not working very well.

But there are other problems as well...

So the floodgates of information showing the failure of the emergency rental assistance model had opened before the third round became final. But that was still too late, and Wikipedia’s summary of the drama is quite useful. The American Rescue Plan was introduced in Congress already in January, and both the House and Senate passed versions of the bill in late February/early March. Clearly — since the need for relief was acute — there was no possibility of major amendments based on information that became available in February and March.

But surely, had Republicans wanted to cooperate with Democrats in dealing with the consequences of a once-per-century global pandemic, there would have been time to design a different approach. Though Democrats might not have done so, Republican obstructionism precluded a new approach that would have prevented armageddon.

Slap in the face, ctd.

Above the red line, we looked at one of Biden’s empty gestures for tenants facing armageddon. Here are a few more:

Second on Biden’s list of things he would do to help renters was “Highlight that American Rescue Plan Funds for State and Local Governments and for Emergency Rental Assistance Can Be Used to Fund Eviction Diversion Plans, Including Counseling, Navigator, and Legal Services.” If state and local governments have been unable to get emergency rental assistance programs operational in the 15 months since the first round of emergency rental assistance, why would they be able to implement diversion, counseling, navigator, or legal services in five weeks?

Biden also said he would “Convene a White House Summit for Immediate Eviction Prevention Plans.” Not sure five weeks is enough time to convene a summit and implement any ideas it generates.

My favorite item is “Make Clear the Fair Housing Act Must Be Followed.” President Biden would point to a law that already exists: friendly reminder that breaking the law is against the law. It’s very difficult to see how this helps tenants who are behind on rent.

The White House Eviction Prevention Summit did take place earlier this month. It involved people who already agree about the scourge of evictions talking to each other in Zoom breakout rooms about the scourge of evictions. Of course, the problem isn’t a lack of talking, but rather the fact that state and local governments can’t (or won’t) do what needs to be done to avert catastrophe. The product of the summit was a 5-paragraph summary.

On the one hand, there were concrete things Biden could have done. He could have closed some of the many gaping loopholes in the moratorium. He could have extended the eviction moratorium for several months, pointing to that astonishing finding from Eviction Lab (emphasis added): “We found a pattern of higher eviction filing rates in neighborhoods with lower vaccination rates in every jurisdiction for which we were able to locate data.”

But as we discussed at the beginning of this issue, the emergency rental assistance model simply doesn’t work. In other words, Biden’s hands were tied— because he tied his own hands passing a policy he should have known would fail.

Public costs of eviction armageddon

Aside from the catastrophic human suffering the eviction armageddon will unleash, the public will also bear enormous fiscal costs. Portland State University researchers calculated that if the estimated 125,000 Oregonians unable to catch up on rent were all evicted on July 1 (the report was done when the moratorium was scheduled to expire on June 30), the State of Oregon would likely have to spend billions of dollars on social services to deal with the fallout:

To calculate the downstream costs of evictions, the researchers used a calculator developed by the University of Arizona. The calculator takes in inputs related to how much emergency shelters, medical services, and child welfare cost in the state and churns out an amount for the statewide costs of eviction.

But the authors warn the output is likely not painting a full picture. The calculation doesn’t take into account other destabilizing consequences of eviction, such as gaps in educational achievement and the impact to earnings later in life.

“Considering these factors, the $720 million to $4.7 billion calculation is likely an underestimate,” the report states.

With a population of 4.22 million, that’s potentially $1,114 per Oregon resident. A majority of Oregonians are homeowners; in other words, the costs will be tremendous in order to preserve the right of a small number of people to evict their tenants.

Urban Institute finds that

An eviction leads to significant hardships for a family. In addition to losing their home and the accompanying psychological distress, they may lose their personal belongings, children may have their education disrupted, and adults may experience job loss (PDF)...The loss of employment and belongings, as well as the costs associated with moving and securing new accommodations, is significant. Based on a number of studies, we estimate that if the 4.2 million adults who report being at risk of eviction in the next two months were actually evicted, it could result in a total of $6.6 billion in lost earnings (PDF) and $5.0 billion in increased debt (PDF) for those tenants.

For the public:

A recent study (PDF) estimated emergency shelter costs nearly $5,000 per month per family, and re-housing a family costs approximately $7,000, with households receiving assistance for an average of seven months.

This estimate from the Urban Institute doesn’t include costs like child welfare, medical costs, etc.

California Dreamin’

California made the news with a plan to forgive all unpaid rent for low-income households; David Dayen douses cold water on this:

Gov. Gavin Newsom, whose name will be on the ballot in a matter of months in a recall election, said on Monday that the state will pay off all past-due rent that accrued during the pandemic for tenants making 80 percent of the median income in their area or less...It sounds miraculous, until you realize it’s actually already been approved. California will not need to add one dime to cover the amount of back rent eligible for cancellation; [t]he money comes from federally approved rental assistance programs.

The fact that it hasn’t been already used to wipe out past rental debt, to the extent that Newsom had to announce a new initiative, is the bigger story. Through May 31, the rental assistance programs authorized in relief bills in December and March had delivered just $32 million to California borrowers, not even 1 percent of the total available amount. Arizona has released 10 percent of its aid, which looks like a model of efficiency comparatively.

What’s being pitched as relief for renters is really more of a bailout for landlords:

The new bill, AB 832, allows tenants and landlords to receive 100% of the back rent. That’s an increase from the previous program, where landlords could only receive 80% of what they were owed, and had to agree to forgive the remaining 20%. Landlords or tenants who have already applied or received funding, will automatically have their payments go up to 100%.

So instead of attempting to force landlords to forgive a fraction of unpaid rent in order to get a huge pile of cash, they’re just giving landlords a bigger pile of cash.